How to Start Flipping Houses – with $0

The real estate market can present you many different opportunities to make money if you’re willing to invest the time and capital into it. In fact, there are a multitude of such profitable sub-niches that most beginners have a hard time deciding where to even start.

One of the most popular methods of generating income via real estate is house flipping. House flipping is so profitable that many experts in the real estate space build their entire careers around it.

It is also a vetted way to get a headstart in the market if you’re not very familiar with the process of development and leasing. However, many new investors and developers do not understand how to navigate this segment of the industry and are not able to make the most out of it. This guide lays out how to start flipping houses with $0 to little capital.

You can start house flipping, even if you have little to no money of your own. To achieve this, there are usually three routes you can follow:

Hard Money Loan/Lender: A hard money loan is simply a loan that is guarded by real estate. Hard money loans usually have interest rates of 12% to 18% and typically have terms of less than one year.

Private loan: This kind of loan is one gotten from a private lender. A private lender is someone with enough individual resources to invest in your flip. With a solid network, it is possible to find private lenders, although it's very rare.

Real estate wholesale: In real estate wholesaling, a seller contracts a home with a wholesaler, then finds an interested party to buy it.

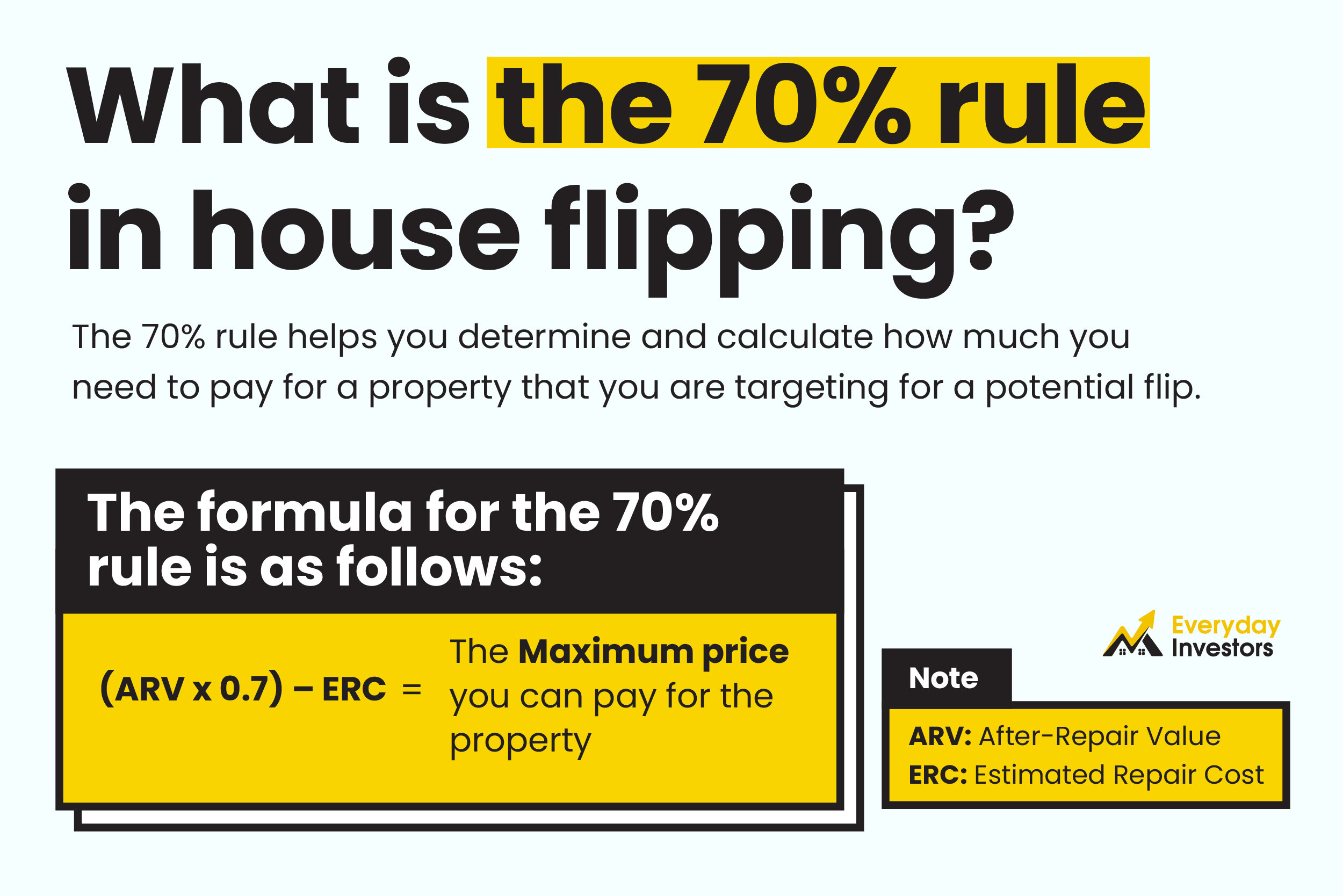

What is the 70% rule in house flipping?

If you choose to get a loan or sign an agreement with an investor, you will need the 70% rule. The 70% rule helps you determine and calculate how much you need to pay for a property that you are targeting for a potential flip. It creates a set of financial guidelines that will prevent you from overbidding for property and running at a loss.

The formula for the 70% rule is as follows:

[ (ARV x 0.7) – ERC = The Maximum price you can pay for the property. ]

The ARV is the after-repair value of the property. It is an estimate of the property's future sales price after you have made repairs and upgrades. You get the ARV by adding the property's purchase price to the value of all the renovations or repairs you will carry out.

On the other hand, the ERC is the estimated repair cost. To calculate this, you sum up the costs and prices of the repair work that needs to be done. This figure must include the cost of material, services, staffing, and time spent.

The "70" in the 70 percent rule indicates the discount that the property must be bought at, before adding any costs of repairs, to allow a sufficient 30% margin that covers the cost of transfer and holding, as well as any profit.

The 70% rule is regarded as a golden rule among house flipping groups. However, it was not always a formal theory. House flippers created this guide to calculate a rough estimate of their potential profits on a project, and eventually, it became popular and widely accepted.

Where to start if you want to flip houses

The process of house flipping is a straightforward one. You simply need to buy a property at a discounted price due to wear and depreciation. Then, after renovating and refurbishing it, you sell it for a profit.

However, several factors and activities go into this seemingly simple process. Ignoring these factors would be equivalent to setting yourself up for failure.

Here are some of the steps you need to complete on your journey to your first successful flip:

1. Research, research, and research.

The first step in a house flip of any size and amount is to know what market you are heading into. Many new investors and developers don’t research the market and are not aware of all the different classes in the real estate market. These classes are grouped across neighborhood types, e.g., high-class, low-income, business districts. Identifying the class will help you set your expectations accordingly and be prepared for the project.

2. Create a business plan and a budget

One of the top mistakes new house flippers make is underestimating how much they will need to start and finish a new house flip. If you are approaching investors and money lenders to secure capital, you will need to create both a business plan and a budget. They must detail how you intend to go about the project, any renovations you want to make, and who your potential final client is.

Like every business venture, house flipping is not a risk-free game. These risks could be picking the wrong property, over-spending on renovations, or even not finding any buyers after all the work is done. To mitigate against all these potential problems, you need to focus on learning the real estate market and the ins and outs of flipping BEFORE you attempt to make your first flip. You can learn from seasoned real estate experts like us and actively seek out beneficial partnerships to ensure your business succeeds. So good job on taking the time to educate yourself so far!

How much money do you need to start flipping houses?

You can decide how much you like to spend as you begin your journey into house flipping. Homes in some areas can cost as little as $100,000, and in other areas, you can expect to buy for $1M and above. It depends on what class of the market you want to flip in. ROI on flipping can be as high as double the cost of the project. To get maximum ROI out of your property, it is advisable to work with reputable and competent real estate agents to market the home when it is finished.

You want to be very careful about keeping costs low as you proceed with your flip, and the best way to control your budget is to use the 70% rule.

Honestly, there is no uniform blanket model to accurately evaluate a flipping project's value and profitability potential. Regardless of this, the 70% rule does an excellent job of proving an estimate on these figures that is as close to accurate as possible.

Conclusion

House flipping is one of the best ways to succeed in the real estate housing market. As long as you apply what you’ve learned and follow the market rules, you’ll be able to find and make some very successful flips. If you want to learn how to successfully flip a house, check out our easy step-by-step guide.

Our goal is to help investors get started and make the best return on their money from every development project they embark on. Get more FREE content on how to invest in real estate by joining our community list.